Introduction:

Finance, a dynamic and integral part of our global economy, encompasses a vast array of activities ranging from personal budgeting to complex international transactions. This article delves into the multifaceted world of finance, exploring current trends, strategic considerations, and the broader economic impact of financial systems.

Financial Markets and Instruments:

Financial markets serve as the backbone of economic activity, facilitating the exchange of capital between borrowers and lenders. Equities, bonds, commodities, and derivatives are among the myriad financial instruments traded in these markets. Equities represent ownership in a company, bonds signify debt obligations, commodities include physical goods like gold and oil, and derivatives derive their value from underlying assets. The interconnectedness of these instruments creates a complex web that reflects the state of the economy and investor sentiment.

Investment Strategies:

Investors employ diverse strategies to navigate financial markets, each tailored to individual risk tolerance, financial goals, and time horizons. Long-term investors often embrace a buy-and-hold strategy, focusing on the fundamental performance of assets over time. Value investors seek undervalued securities with the potential for long-term growth, while momentum investors capitalize on short-term market trends. Diversification, asset allocation, and risk management are fundamental principles guiding successful investment strategies.

Fintech Revolution:

The intersection of finance and technology, commonly known as fintech, has transformed the financial landscape. Fintech encompasses a wide range of innovations, including online banking, mobile payment apps, robo-advisors, and blockchain technology. Online platforms and mobile apps provide users with unprecedented access to financial services, simplifying transactions and democratizing investment opportunities. Blockchain, the decentralized ledger technology behind cryptocurrencies, promises secure and transparent transactions, influencing sectors beyond traditional finance.

Cryptocurrencies and Decentralized Finance (DeFi):

Cryptocurrencies like Bitcoin and Ethereum have disrupted traditional notions of currency and finance. Decentralized Finance (DeFi) platforms, built on blockchain technology, aim to recreate traditional financial services without the need for intermediaries. Smart contracts, automated protocols that execute predefined rules, enable lending, borrowing, and trading without traditional banks. While the potential for financial inclusion and innovation is significant, regulatory challenges, volatility, and security concerns remain critical considerations in the evolving landscape of cryptocurrencies and DeFi.

Economic Indicators and Monetary Policy:

Economic indicators, such as GDP growth, unemployment rates, and inflation, provide crucial insights into the health of an economy. Central banks, including the Federal Reserve in the United States and the European Central Bank, utilize monetary policy tools to influence economic conditions. Interest rates, quantitative easing, and open market operations are among the instruments employed to manage inflation, stimulate economic growth, and maintain financial stability. The delicate balance of these policies plays a pivotal role in shaping the overall economic landscape.

Global Trade and Capital Flows:

Finance is intricately linked with global trade and capital flows. International financial markets facilitate cross-border transactions, allowing businesses to access capital and investors to diversify portfolios globally. Currency exchange rates and trade balances influence economic relationships between nations. Trade tensions, geopolitical events, and fluctuations in currency values impact the interconnected global financial system, underscoring the importance of a stable and cooperative international financial framework.

Risk Management and Insurance:

Risk is inherent in financial activities, and risk management is a critical component of sound financial decision-making. Insurance products, ranging from life and health insurance to property and casualty coverage, provide individuals and businesses with protection against unexpected events. Financial derivatives, such as options and futures contracts, enable market participants to hedge against price fluctuations and manage risk exposure. The effective integration of risk management practices is essential for maintaining financial resilience in the face of uncertainty.

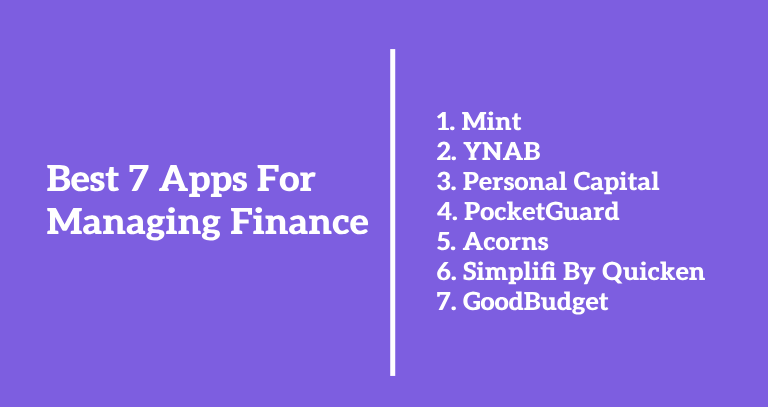

Personal Finance and Financial Literacy:

On an individual level, personal finance plays a pivotal role in achieving financial well-being. Budgeting, saving, investing, and retirement planning are key components of personal finance. Financial literacy, the ability to understand and manage one’s finances effectively, is crucial in making informed decisions. Educational initiatives and resources aimed at improving financial literacy empower individuals to navigate the complexities of personal finance and build a secure financial future.

Corporate Finance and Capital Structure:

In the corporate realm, finance plays a central role in strategic decision-making. Corporate finance involves managing capital structure, capital budgeting, and financial planning. Companies raise capital through a combination of equity and debt, determining the optimal mix to fund operations and growth initiatives. Financial managers analyze investment opportunities, assess risk, and make decisions that align with shareholder value maximization.

Socially Responsible Investing (SRI) and ESG Criteria:

An evolving trend in finance is the emphasis on socially responsible investing (SRI) and Environmental, Social, and Governance (ESG) criteria. SRI considers the social and environmental impact of investments, aligning portfolios with ethical considerations. ESG criteria assess a company’s performance in environmental sustainability, social responsibility, and corporate governance. The integration of SRI and ESG principles reflects a growing awareness of the broader impact of financial activities on society and the environment.

Conclusion:

The realm of finance is a dynamic and multifaceted landscape, influencing every facet of our lives and the global economy. From investment strategies and fintech innovations to economic indicators and risk management, the intricacies of finance shape the way individuals, businesses, and nations interact with the financial system. As we navigate the complexities of the financial world, a holistic understanding of these trends and considerations is essential for making informed decisions that contribute to financial stability, growth, and the overall well-being of society.