In a world driven by instant gratification, long-term investing remains one of the most powerful and time-tested ways to build wealth. While short-term trading and speculation can be tempting, history has shown that patient investors often reap the greatest rewards.

Why Long-Term Investing Works

The concept of long-term investing is rooted in compounding, consistency, and market growth over time. Legendary investor Warren Buffett famously said, “The stock market is a device for transferring money from the impatient to the patient.” This principle highlights how patience and discipline can lead to remarkable financial success.

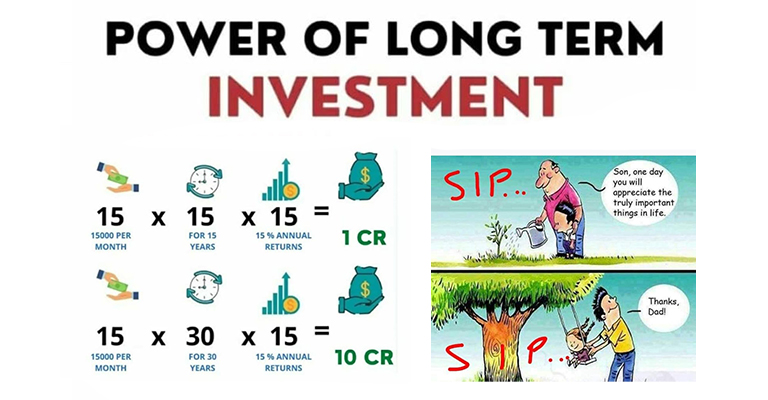

1. The Magic of Compounding

Albert Einstein reportedly called compound interest the “eighth wonder of the world.” Compounding allows your investments to grow exponentially as your returns generate additional returns. The longer you stay invested, the more powerful this effect becomes.

For example, if you invest $10,000 at an average annual return of 8%, in:

- 10 years, it grows to $21,589

- 20 years, it grows to $46,610

- 30 years, it grows to $100,627

This demonstrates how time in the market is more valuable than timing the market.

2. Riding Out Market Volatility

Markets experience ups and downs, but history shows that they generally trend upward over time. Investors who stay committed during downturns often see strong recoveries.

Consider the S&P 500: Despite numerous recessions, crashes, and corrections, it has delivered an average annual return of around 10% over the last century. Those who panic and sell during declines often miss the best recovery periods.

3. Lower Risk, Higher Returns

Short-term trading is risky and unpredictable. Long-term investing reduces risk by allowing the market to smooth out volatility. Investing in diversified assets like index funds, ETFs, and blue-chip stocks can further mitigate risk while ensuring steady growth.

How to Succeed as a Long-Term Investor

- Start Early – The earlier you invest, the more time your money has to grow. Even small amounts can lead to significant wealth over decades.

- Stay Consistent – Regular contributions (e.g., monthly or quarterly) help build a strong portfolio. Dollar-cost averaging reduces the impact of market fluctuations.

- Think Long-Term – Avoid emotional decisions based on short-term news. Stick to your plan and let compounding do the work.

- Diversify – Spread your investments across different asset classes to minimize risk and maximize returns.

- Reinvest Dividends – Instead of cashing out, reinvesting dividends helps accelerate growth.

Final Thoughts

Long-term investing is a marathon, not a sprint. The power of compounding, resilience through market fluctuations, and a disciplined approach can help you achieve financial independence. By staying patient and committed, you set yourself up for sustained wealth and success.

So, start today, stay invested, and let time work its magic! 🚀