Fintech innovations have changed the banking and financial world around us. With the help of technology, all the transactions have become seamless, and managing money is smoother.

Fintech innovations

Fintech innovations

have changed the banking and financial world around us. With the help of technology, all the transactions have become seamless, and managing money is smoother.

But, if we go back to the times and think of the days when we had to go to banks and get the work done standing in long queues waiting for our turn to come. We would never want that time again in our life. This is called taking a step forward to make a better future.

The world of banking is undergoing a profound transformation, and at the heart of this change are Financial Technology (Fintech) innovations. Fintech in India has revolutionized the way we manage, invest, and transact our money. In this blog, we’ll delve into the exciting world of Fintech and explore how it’s shaping the future of banking.

Fintech in India

The Rise of Fintech Innovations: A Disruptive Force

Traditionally, banking has been synonymous with brick-and-mortar institutions. People would visit physical branches, fill out paperwork, and wait in lines to access financial services. However, the rise of Fintech startups has disrupted this age-old model. Fintech companies in India leverage technology to provide financial services that are more accessible, efficient, and user-friendly.

Fintech companies in India

right here

Digital Payments: The Cashless Revolution

These innovations have made it easier than ever to send money to friends, pay for goods and services, and even invest in the digital economy. As a result, cash transactions are steadily declining, and digital wallets are becoming the norm.

Robo-Advisors: Smart Investing for All

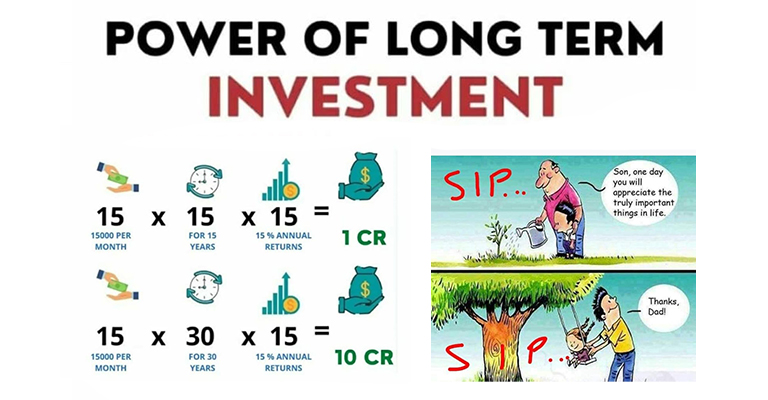

Investing was once considered the domain of the wealthy and the well-informed. However, Fintech has democratized investing through the introduction of robo-advisors. These automated platforms use algorithms to manage investment portfolios, making it accessible to anyone with a smartphone.

Robo-advisors offer diversified portfolios, low fees, and a user-friendly interface. They also provide personalized investment strategies based on an individual’s risk tolerance and financial goals. This innovation is empowering people to grow their wealth without the need for a traditional financial advisor.

Blockchain and Cryptocurrencies: Changing the Financial Landscape

Blockchain technology, the foundation of cryptocurrencies, is reshaping the financial industry. Blockchain offers secure, transparent, and decentralized record-keeping, which has the potential to eliminate fraud and reduce transaction costs significantly. For example, Fintech companies Bangalore that have their product as cryptocurrency has made the buying and selling of crypto coins so easy.

Fintech companies Bangalore

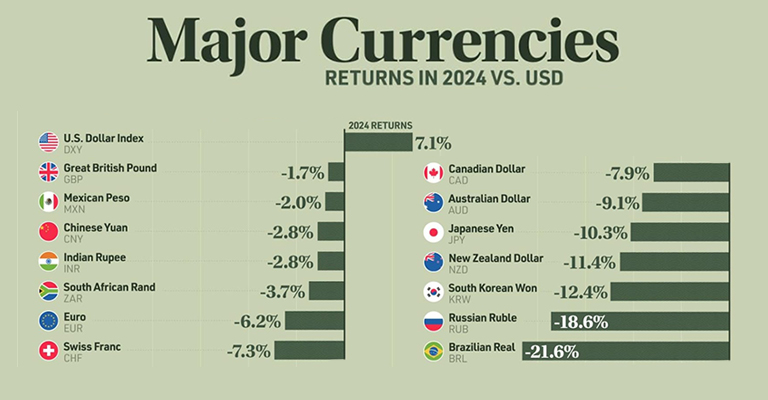

Cryptocurrencies, led by Bitcoin and Ethereum, are challenging traditional currencies and financial systems. They enable borderless transactions, financial inclusion for the unbanked, and a store of value immune to inflation. Central banks worldwide are exploring the possibilities of central bank digital currencies (CBDCs) to stay relevant in this changing landscape.

Open Banking: Empowering Consumers

Open Banking is another Fintech innovation that’s gaining traction. It allows consumers to share their financial data securely with third-party providers, such as budgeting apps and lenders. This data sharing enables users to access personalized financial services and better manage their finances.

By granting permission for access to their financial data, consumers can receive tailored recommendations for saving money, managing debt, or obtaining loans. Open Banking is not only empowering individuals but also fostering competition among financial institutions, ultimately leading to better services and lower costs for consumers.

Artificial Intelligence (AI) and Machine Learning: Personalized Banking

AI and machine learning are at the forefront of Fintech’s evolution. These technologies enable banks and financial institutions to provide personalized experiences to their customers. Chatbots and virtual assistants, powered by AI, can answer queries, assist with transactions, and even provide financial advice 24/7.

Machine learning algorithms analyze vast amounts of data to detect patterns and trends, which can inform investment decisions, risk assessment, and fraud prevention. These advancements in AI are enhancing the efficiency and accuracy of financial services, ultimately benefiting consumers. When we talk about the fintech future with AI, fintech companies in Bangalore are trying hard to implement AI with technology for further improved working of the banks.

fintech companies in Bangalore

Challenges and Regulatory Considerations

While Fintech innovations hold immense promise, they also bring about challenges and regulatory considerations. Cybersecurity threats are a constant concern, given the sensitivity of financial data. Regulatory bodies are working to establish guidelines to protect consumers and maintain the integrity of the financial system.

Privacy issues also come to the forefront as fintech companies in India collect and utilize personal data to deliver tailored services. Striking the right balance between convenience and privacy will be an ongoing challenge.

fintech companies in India

The Future of Banking: Inclusion and Innovation

The future of banking with Fintech at its core is promising. It’s a future where financial services are accessible to everyone, regardless of their location or income. It’s a future where transactions are seamless, investments are within reach, and financial advice is personalized and available 24/7. There are numerous financial technology companies in India that are working in collaboration with the banks to make their system smoother and more efficient.

financial technology companies in India

In the future, traditional banks will continue to adapt, integrating Fintech solutions into their offerings. Collaboration between Fintech startups and established financial institutions will likely be the norm, as both sides recognize the benefits of combining fintech innovation with trust and experience.

fintech innovation

Rundown

Fintech innovations are reshaping the landscape of banking, offering solutions that are efficient, user-centric, and accessible. From digital payments to blockchain and AI-driven services, the future of banking promises greater financial inclusion and convenience.

Fintech innovations

As consumers, we can expect more personalized experiences, better investment opportunities, and increased control over our financial lives. However, it’s essential to remain vigilant about security and privacy concerns as Fintech continues to evolve.

In this rapidly changing landscape, one thing is clear: the future of banking is a dynamic fusion of technology, innovation, and financial empowerment, and it’s an exciting journey that we’re all part of. The future of fintech is the future of India!