In 2024, the U.S. dollar exhibited notable strength against a range of major global currencies, influenced by various economic factors, including interest rate differentials, geopolitical events, and trade policies.

U.S. Dollar Index Performance

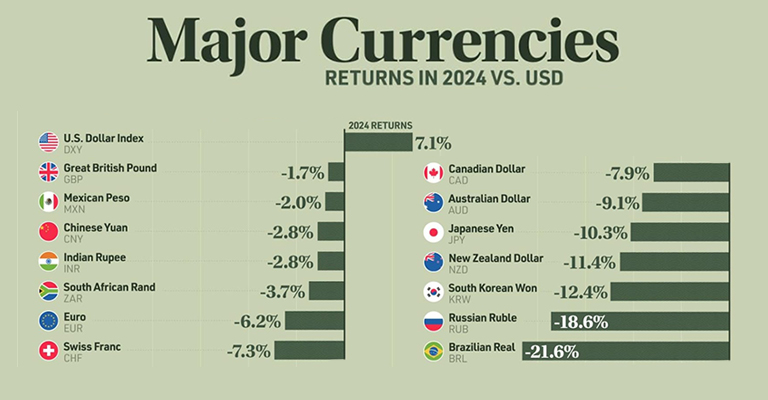

The U.S. Dollar Index (DXY), which measures the dollar against a basket of six major currencies, appreciated by approximately 7.1% over the year. This rise underscores the dollar’s dominance in the global financial landscape during 2024.

Performance of Major Currencies Against the U.S. Dollar

- British Pound (GBP): The pound depreciated by 1.7% against the dollar. Despite this decline, the UK’s relatively high interest rates and political stability under Prime Minister Keir Starmer contributed to a more resilient performance compared to other currencies.

- Euro (EUR): The euro weakened by 6.2% against the dollar, approaching near parity. This decline was attributed to sluggish eurozone growth and subdued economic activity in China.

- Canadian Dollar (CAD): The Canadian dollar fell by 7.9%, reaching a multi-year low of $0.69 USD in December. The decline was influenced by looming tariffs and concerns over the impact on Canada’s trade dynamics with the U.S.

- Japanese Yen (JPY): The yen experienced a significant depreciation of 10.3% against the dollar. Despite a 25 basis point rate hike by the Bank of Japan and increased inflation forecasts, the yen remained under pressure due to the dollar’s strength and higher U.S. Treasury yields.

- Australian Dollar (AUD): The Australian dollar declined by 9.1% against the U.S. dollar. Factors contributing to this decrease included global trade uncertainties and the dollar’s overall appreciation.

- Chinese Yuan (CNY): The yuan depreciated by 2.8% against the dollar, reflecting concerns over China’s economic slowdown and trade tensions with the U.S.

Factors Influencing Currency Movements

Several key factors contributed to the U.S. dollar’s appreciation in 2024:

- Interest Rate Differentials: The Federal Reserve’s monetary policy, including interest rate decisions, played a crucial role in enhancing the dollar’s appeal to investors seeking higher returns.

- Trade Policies: Announcements of tariffs, such as the 25% tariff on goods from Mexico and Canada effective February 1, led to declines in the Canadian dollar and Mexican peso, highlighting the impact of trade tensions on currency valuations.

- Economic Performance: The relative strength of the U.S. economy compared to other regions bolstered the dollar’s position as a safe-haven currency amid global uncertainties.

In summary, 2024 was marked by a robust U.S. dollar that outperformed many major currencies, driven by favorable interest rate differentials, strategic trade policies, and the overall resilience of the U.S. economy.