Save Money to have a better investment in the future.

Save Money to have a better investment in the future.

If you are exhausted with spending money and not able to find the right way to make enough savings, here we go with the right saving methods for you. Check out our 9 tips to save money and fulfill all your dreams. Having a fixed goal relaxes you, though saving and budgeting become challenging. However, the best way to invest cash is to save it first. You can see an exciting feature in which you are buying a house for yourself, your favorite car, starting a family, or anything else. Money can buy anything if you do wise saving!

9 Tips to Save Money- Bharatvit’s Recommendations

If you wonder, how you can save money faster, delve into our money saving tips and suggestions to level up your bank balance swiftly.

1. SAVE MONEY: KNOW YOUR FINANCES AND BUDGET

The foremost tip to save money is quite simple. Budget out! If you have control of your budget, you will be in control of the finances. But where and how to start?

To begin with, saving money every month, you need to have a grip on the cash flow. Through this we infer you have all the inflow and outflow revenue streams, considering any debt repayment, saving contributions, and monthly bills in the money markets.

Here’s how you can make a budget to start living peacefully with money saving tips.

- Track all your finances every month. This involves all the income and expenses.

- Make a comparison of your monthly income and expenses to evaluate how much you have managed currently, to save money, or how much overspends you are doing each month.

- Place your expenditures into different categories such as fixed and variables.

- Fixed costs include expenses that cannot be adjusted, such as your rent, utility bills, and maintenance.

- Variable costs involve adjustable expenses such as groceries, subscription services, and entertainment.

- Check out the variable cost that can be cut back to make an assessment on the saving part every month.

- Evaluate regular progress and make adjustments accordingly, if needed.

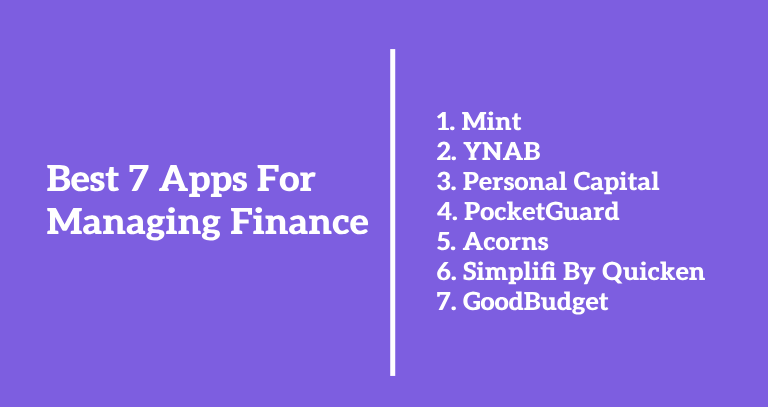

- If you find it difficult to do so, make use of budgeting apps that can help you budget easily.

2. SAVE MONEY: COME OUT OF HEAVY DEBT

Pay the outstanding balances on the existing debts, to begin with saving and investment. The more you delay paying off the debts, the higher it becomes in these money markets. This happens because the price you need to pay keeps on adding money over the time period. If you put off your debt, the interest will accrue and it will wipe out any money you have saved.

3. SAVE MONEY: MAKE A DESIGNATED SAVINGS ACCOUNT

In order to save money swiftly, separate the daily needs spending from the amount you want to save. You will need to have a designated savings account for this purpose.

Doing so will minimize your risk of emptying out the savings funds to cope with the daily expenses. In fact, it encourages you to remain within the day-to-day budget while keeping the savings intact from unnecessary temptations!

4. SAVE MONEY: CREATE AUTOMATED SAVING

5. SAVE MONEY: AUTOMATE YOUR BILLS

6. SAVE MONEY: PUT A SPENDING LIMIT ON YOUR CARD

This will save you from the over expenditures before times. There are many banks in the money market that offer such services.

7. SAVE MONEY: MAKE USE OF THE ENVELOPE BUDGETING SYSTEM

Next one of the best saving tips, is to use Dave Ramsey’s envelope budgeting system. This involves taking monthly income in physical cash out of the bank at the beginning of every month and allotting them into separate envelopes.

Every envelope represents your budgeting goals. These envelopes will be your fixed costs envelopes will be for example utility bills, rent, etc. and envelopes for variable costs will be groceries, subscriptions, etc. This is the best saving plan. When you pay everything as a fixed amount of physical cash, you will make sure you remain under budget for every type of expense.

8. SAVE MONEY: CUT BACK YOUR RENT

Cutting back on the rent expenses is a quick and best money saving plan for you. If you are living alone, you can start living with a roommate to begin with money saving tips thus, in turn, enhancing your investment saving too as this will half your rent. This will also save electric bill for you. If you have chosen a shared apartment, you can swap to a smaller room too. Rent rates are generally, calculated through the size of the room, this is how you can make savings each month.

9. SAVE MONEY: CANCEL ANY UNUSED SUBSCRIPTIONS

It is a money-making dream for a lot of companies in the money markets. This happens because of the customer subscription to the service, they are generally reluctant to subscribe—even if they don’t use it. This leads to the sunk cost fallacy. It means that canceling rare subscriptions is hard, as you already have paid for the money. Therefore, you need to cancel the subscription accepting that it is one of the most important money saving tips.

Rundown

If you follow these money saving tips, you can find the best place to invest money and also have enough money saved. Don’t wait for the right time just begin with these Bharatvit money-saving hacks and start investing!