In the fast-paced digital world of today where digital payments have become the norm, it is crucial to manage your finances.

In earlier times, when transactions were made through hard cash, people always knew the amount of money remaining in their wallets.

Nowadays with digital payments, most people do not have a clue of the remaining balance of their digital wallet or bank account.

Even big payments like Rs. 50,000 don’t bother an individual now as against earlier times when paying such a huge sum of hard cash pinched a person.

Therefore, with money losing its value and people using UPI payments 20 times a day, it is more important than ever that individuals manage their finances properly.

In this blog, we will talk about the need to use apps for managing finance as well as the top 7 apps for managing finance ultimately helping you achieve your financial goals.

Need For Apps For Managing Finance

With digitization taking over the world, the need for apps for managing finance is absolutely necessary.

To help individuals meet their financial goals and maintain financial stability, it is imperative that they use apps for managing finances.

Further, apps for managing finance are needed and important because –

- Convenience & Accessibility – Apps for managing finance or Finance Management Apps provide an individual with their financial information on the go. This information can range from their account balance, expense tracking, or even investments. As a result, with a touch of their fingers, individuals can access and stay in a loop with respect to their financial situation thus being empowered to make informed and sound financial decisions.

- Real-Time Tracking – Financial management apps help keep track of your money through real-time tracking, unlike the traditional methods. As a result, you can adjust your investments, identify issues as and when they appear, and be completely updated about your financial health and status.

- Budgeting – To achieve financial success, it is imperative that an individual creates as well as sticks to a budget. Financial management apps helps an individual categorize their spending and reflect on their habits as well as send alerts if they surpass their set spending limit for a particular category. This helps an individual maintain financial discipline and meet their monthly savings quota.

- Automatic Expense Tracking – Filled with the possibility of human errors, manual tracking of expenses can be a tiresome and tedious task. To help with this, the financial management apps automate this process by being linked to your bank accounts and credit cards, thus providing a categorized and detailed report. Additionally, this also leads to 100% accuracy in the individual’s financial records.

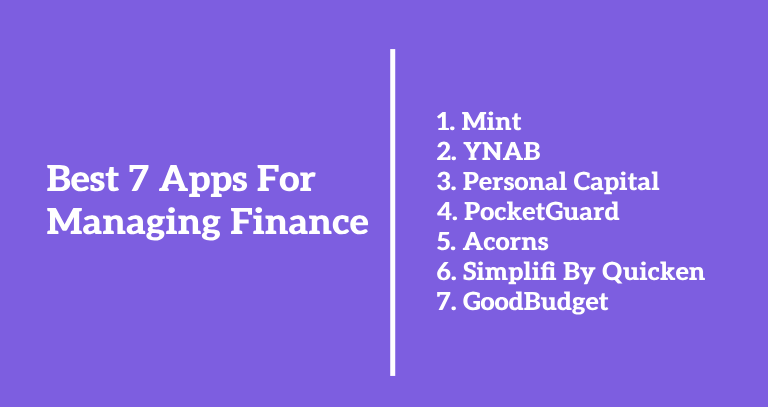

Best 7 Apps For Managing Finance (Financial Management Apps)

Here is a list of the best 7 apps for managing finance that help an individual maintain their financial stability while moving towards financial growth –

- Mint – A comprehensive finance app, Mint requires an individual to link their bank accounts, credit cards, and investment accounts in one place. As a result, the app automates the categorization of spending, providing insights into spending habits and recommending a personalized budget based on the individual’s habits. Further, the Mint app sends its users alerts with respect to unusual activities as well as upcoming bills.

- YNAB (You Need A Budget) – YNAB is a finance app that helps an individual take control of their money in order to break their paycheck-by-paycheck living approach by using a zero-based budgeting technique. In the app, each dollar has a specific purpose which implies that the app helps you to allocate funds to various categories and prioritize your spending hence eliminating unnecessary spending.

- Personal Capital – A wealth management app using budgeting tools with investment tracking, Personal Capital provides its users with insights about their financial life that include details on their net worth, cash flow as well as retirement planning. As a wealth management app, the app helps the individual optimize their portfolio and plan for financial success that is long-term and sustainable.

- PocketGuard – As the name suggests, PocketGuard has been launched in the market to guard the pockets of its users to help them attain financial stability. PocketGuard is a user-friendly app that has simplified expense tracking and budgeting for users. Providing a clear overview of the financial situation of the user, the app in addition to categorizing expenses also provides opportunities to save to the users. The app also has a special feature called “In My Pocket” that reflects the discretionary amount left with the user after the payment of all their bills and usual expenses as well as savings amount.

- Acorns – Categorized under an innovative financial management app, Acorns helps the user invest their spare change from the transactions that they make. This implies that for every transaction you make through your linked debit and credit cards, Acorns rounds it up to the nearest dollar and the spare change is invested in a diversified portfolio for the user. This type of micro-investing helps an individual build their wealth from their hard-earned money without any type of significant investment.

- Simplifi By Quicken – For users looking for a straightforward method for financial management, Simplifi is the ideal budgeting app for them with its user-friendly interface that focuses on simplicity and effectiveness. The app provides the user with a clear view of their financial picture, tracks their spending, and helps the user set realistic financial goals.

- GoodBudget – Based on the envelope budgeting system, GoodBudget is ideal for users who look for an approach to budgeting that is tangible. In this financial management app, an individual allocates various amounts of cash to virtual envelopes for the various categories that the user has for spending. As a result, the app helps an individual stick to their budget by virtually representing their spending limits.

Conclusion

To attain financial success, it is imperative in this digital age that individuals leverage the power of apps for managing finance or financial management apps.

These apps help to streamline and automate the budgeting process as well as provide insights to the user with respect to their spending, investments and overall financial health.