Understanding the dynamics that drive financial markets is crucial for both investors and fund managers. Market trends, which are shifts or movements in financial markets over time, can significantly impact investment funds. The Helios Financial Services Fund, known for its robust portfolio and strategic investment approach, is no exception. This blog will delve into how market trends influence the Helios Financial Services Fund, examining various factors, providing insights into its performance, and offering guidance for investors.

Table of Contents

- Introduction to Market Trends

- Overview of the Helios Financial Services Fund

- Key Market Trends Influencing Helios Financial Services Fund

- Economic Indicators

- Interest Rates

- Technological Advancements

- Geopolitical Events

- Market Sentiment

- Analyzing Historical Performance

- Strategies Employed by Helios Financial Services Fund

- Forecasting Future Market Trends

- How Investors Can Navigate Market Trends

- FAQs about Market Trends and Helios Financial Services Fund

1. Introduction to Market Trends

Market trends are the directional movements in financial markets over time, influenced by various factors. Understanding these trends is crucial for informed investment decisions and strategic planning.

Types of Market Trends

- Bullish Trends (Upward Trends)

-

-

- Rising asset prices indicate investor optimism and confidence.

- Driven by positive economic indicators like GDP growth and low unemployment.

- Examples: Post-recession recoveries, tech booms.

-

- Bearish Trends (Downward Trends)

-

-

- Declining asset prices reflect pessimism and lack of confidence.

- Triggered by economic downturns, geopolitical instability, and poor corporate performance.

- Examples: Financial crises, sectoral declines.

-

- Sideways Trends (Neutral Trends)

-

- Asset prices move within a narrow range, showing market indecision.

- Common during market consolidation phases or economic stagnation.

- Examples: Periods following significant market movements, stagnant economic periods.

Factors Influencing Market Trends

- Economic Indicators

-

-

- GDP growth, inflation rates, unemployment levels, and consumer spending impact market trends.

- Positive indicators drive bullish trends; negative indicators lead to bearish trends.

-

- Interest Rates

-

-

- Central bank policies on interest rates influence market sentiment and economic activity.

- Lower rates stimulate growth (bullish); higher rates can slow activity (bearish).

-

- Corporate Performance

-

-

- Strong earnings and positive outlooks boost stock prices (bullish); weak earnings cause declines (bearish).

-

- Technological Advancements

-

-

- Innovations create new investment opportunities and drive market trends.

- Examples: Fintech revolution, green technologies.

-

- Geopolitical Events

-

- Elections, trade wars, and regulatory changes create market volatility and influence trends.

- Examples: National elections, international trade disputes.

2. Overview of the Helios Financial Services Fund

The Helios Financial Services Fund is a well-established investment fund that focuses on financial services. Its portfolio includes investments in banking, insurance, asset management, and other financial institutions. The fund aims to deliver consistent returns to its investors by leveraging its expertise in the financial sector and adapting to market trends. To achieve this, the fund employs a variety of strategies and principles:

- Diversification: By spreading investments across various financial sectors, the fund mitigates risk and capitalizes on different growth opportunities.

- Market Analysis: Regularly analyzing market trends and economic indicators to make informed investment decisions.

- Active Management: Continuously monitoring and adjusting the portfolio to respond to market changes and seize new opportunities.

- Risk Management: Implementing rigorous risk management practices to protect investor capital and ensure stability.

- Innovation: Staying abreast of technological advancements and incorporating innovative financial services and products into the portfolio.

- Long-term Focus: Maintaining a long-term investment horizon to weather short-term market volatility and achieve sustainable growth.

- Expertise: Leveraging a team of seasoned professionals with deep knowledge of the financial sector to guide investment decisions.

- Regulatory Awareness: Keeping informed about regulatory changes and adapting strategies to comply with new regulations while capitalizing on potential benefits.

3. Key Market Trends Influencing Helios Financial Services Fund

Economic Indicators

Economic indicators are statistics that provide insights into the overall health and performance of an economy. These indicators are crucial for investors, policymakers, and businesses as they help gauge the current state of the economy and predict future trends. Understanding how economic indicators impact the financial sector is essential for making informed investment decisions. Here’s a detailed look at some key economic indicators:

- Gross Domestic Product (GDP): GDP measures the total value of all goods and services produced within a country’s borders in a specific period. It is considered one of the most important indicators of economic health. High GDP growth rates indicate a healthy economy and often lead to increased investor confidence and bullish market trends.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed and actively seeking employment. A low unemployment rate is typically seen as a positive sign for the economy, as it indicates that more people are employed and have disposable income to spend. This can lead to increased consumer spending, which is beneficial for the financial sector and can contribute to bullish market trends.

- Consumer Spending: Consumer spending is the total amount of money spent by consumers on goods and services. It is a key driver of economic growth, as consumer spending accounts for a significant portion of GDP. High consumer spending indicates a strong economy and can lead to bullish market trends, especially in sectors that rely heavily on consumer demand, such as retail and consumer goods.

Interest Rates

Interest rates play a critical role in the financial services industry, impacting various aspects of the economy and financial markets. Central banks use interest rates as a monetary policy tool to control inflation, stimulate economic growth, and regulate financial markets. Understanding how interest rates affect the financial services industry is essential for investors and financial institutions alike. Here’s a detailed look at the impact of interest rates:

- Borrowing Costs: Changes in interest rates directly affect the cost of borrowing for individuals, businesses, and governments. When interest rates rise, borrowing becomes more expensive, leading to higher costs for mortgages, car loans, and other forms of credit. This can reduce consumer spending and investment, slowing down economic growth.

- Lending Margins: Interest rates also impact the profitability of banks and other financial institutions. When central banks raise interest rates, banks typically increase the interest rates they charge on loans, improving their lending margins. This can lead to higher profits for banks and financial institutions, benefiting their shareholders.

- Savings and Investments: Higher interest rates can make savings accounts, certificates of deposit (CDs), and other interest-bearing investments more attractive to investors. This can encourage saving and investment, which can stimulate economic growth. However, it can also lead to reduced consumer spending, as people may choose to save rather than spend.

- Asset Prices: Changes in interest rates can also affect the prices of assets such as stocks, bonds, and real estate. When interest rates rise, the cost of borrowing increases, which can reduce the demand for assets bought with borrowed money. This can lead to lower asset prices, affecting the overall value of investment portfolios.

Technological Advancements

Technological Advancements in Financial Services

Technological advancements are transforming the financial services industry, revolutionizing how financial transactions are conducted, services are delivered, and risks are managed. The emergence of fintech innovations, blockchain technology, and digital banking has created new opportunities and challenges for financial institutions. Understanding these technological advancements and their impact on the financial services industry is crucial for investors and fund managers. Here’s an in-depth look at these advancements:

-

- Fintech Innovations: Fintech, short for financial technology, refers to the use of technology to improve and automate financial services. Fintech innovations include mobile payment apps, peer-to-peer lending platforms, robo-advisors, and digital wallets. These innovations are making financial services more accessible, efficient, and cost-effective for consumers and businesses.

- Blockchain Technology: Blockchain is a decentralized, distributed ledger technology that securely records transactions across multiple computers. It has the potential to revolutionize financial services by improving transparency, security, and efficiency. Blockchain is used in cryptocurrency transactions, smart contracts, and supply chain management, among other applications.

- Digital Banking: Digital banking, also known as online or internet banking, allows customers to conduct banking transactions over the internet. It includes services such as online bill payments, fund transfers, and account management. Digital banking offers convenience and accessibility to customers, reducing the need for physical bank branches.

- Impact on the Helios Financial Services Fund:

-

- Investment Opportunities: Technological advancements in financial services present new investment opportunities for the Helios Financial Services Fund. By investing in fintech startups, blockchain projects, and digital banking platforms, the fund can capitalize on the growth potential of these technologies.

- Adaptability: The fund’s ability to adapt to technological changes is crucial for its performance. By staying abreast of fintech trends and integrating innovative technologies into its investment strategy, the fund can enhance its competitiveness and attract investors.

- Risk Management: Technological advancements also pose risks to the financial services industry, such as cybersecurity threats and regulatory challenges. The fund must implement robust risk management practices to mitigate these risks and protect investor capital.

Geopolitical Events

Geopolitical events, such as elections, trade wars, and international conflicts, can create volatility in financial markets. These events have the potential to impact global economies, currencies, and financial assets, leading to fluctuations in market prices. Understanding the impact of geopolitical events on financial markets is essential for investors and fund managers, including the Helios Financial Services Fund. Here’s a closer look at how these events can affect financial markets:

- Elections: Elections in key countries can have a significant impact on financial markets. Changes in government leadership can lead to shifts in economic policies, which can affect investor sentiment and market confidence. Close or contested elections can create uncertainty, leading to increased market volatility.

- Trade Wars: Trade wars, characterized by tariffs and trade barriers between countries, can disrupt global trade and supply chains. Trade tensions can lead to uncertainty in financial markets, affecting the prices of stocks, currencies, and commodities. The imposition of tariffs can also impact corporate earnings and economic growth.

- International Conflicts: International conflicts, such as military conflicts or geopolitical tensions, can have a profound impact on financial markets. These events can lead to risk aversion among investors, causing them to flee to safe-haven assets such as gold and government bonds. Increased geopolitical tensions can also lead to higher oil prices, impacting inflation and economic growth.

Market Sentiment

Market sentiment, driven by investor perceptions and emotions, plays a crucial role in market trends. Positive sentiment can drive up stock prices, while negative sentiment can lead to market downturns. Understanding market sentiment helps the Helios Financial Services Fund make strategic investment decisions.

Market Sentiment Overview:

- Market sentiment is driven by investor perceptions and emotions.

- Positive sentiment can lead to higher stock prices, while negative sentiment can result in market downturns.

Factors Influencing Market Sentiment:

- Economic Indicators: Strong economic data can boost investor confidence.

- Geopolitical Events: Political instability or conflicts can create uncertainty.

- Corporate Performance: Positive earnings reports can improve sentiment.

Role in Investment Decisions:

- Understanding market sentiment helps the fund make strategic investment decisions.

- It allows the fund to capitalize on opportunities and protect investments during market volatility.

Risk Management:

- Monitoring market sentiment is crucial for effective risk management.

- It helps the fund identify potential risks and adjust its strategy accordingly.

Long-Term Strategy:

- By analyzing market sentiment, the fund can develop a long-term investment strategy.

- This strategy can help the fund achieve its investment objectives despite short-term market fluctuations.

4. Analyzing Historical Performance

Examining the historical performance of the Helios Financial Services Fund provides insights into how it has responded to past market trends. By analyzing performance data, we can identify patterns and understand the fund’s resilience and adaptability.

Insights from Historical Performance:

- Historical performance provides insights into the fund’s past responses to market trends.

- It helps identify patterns and understand the fund’s resilience and adaptability.

Analyzing Performance Data:

- Performance data includes returns, volatility, and other metrics over time.

- By analyzing this data, we can assess how the fund has performed in different market conditions.

Identifying Patterns:

- Examining historical performance helps identify patterns and trends.

- This can provide valuable insights for future investment decisions.

Understanding Resilience and Adaptability:

- Historical performance data can reveal how the fund has weathered market downturns and capitalized on upswings.

- It helps assess the fund’s ability to adapt to changing market conditions.

Informing Investment Decisions:

- Insights from historical performance can inform future investment decisions.

- They provide a basis for evaluating the fund’s potential performance in different scenarios.

5. Strategies Employed by Helios Financial Services Fund

The Helios Financial Services Fund employs various strategies to navigate market trends and achieve its investment objectives. These strategies include:

Diversification

- Risk Mitigation: Diversification reduces the impact of individual asset volatility on the overall portfolio.

- Enhanced Returns: By investing in different sectors and geographies, the fund can capitalize on growth opportunities.

- Stability: A diversified portfolio is less vulnerable to economic downturns or sector-specific issues.

- Reduced Correlation: Investments in uncorrelated assets can lower portfolio volatility.

Active Management

The fund’s active management approach involves continuously monitoring market trends and adjusting the portfolio to capitalize on opportunities and manage risks.

- Continuous Monitoring: The fund actively tracks market trends, economic indicators, and geopolitical events.

- Opportunistic Adjustments: Portfolio adjustments are made based on changing market conditions and emerging opportunities.

- Risk Management: Active management includes strategies to mitigate risks and protect the fund’s investments.

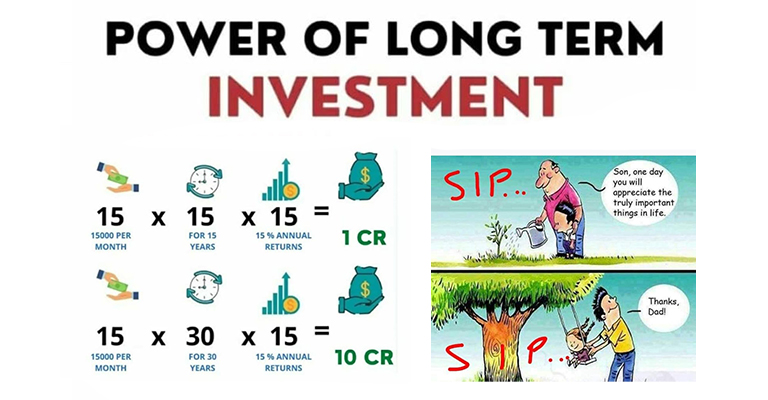

Long-term Focus

A long-term investment focus allows the fund to ride out short-term market volatility and benefit from sustained growth in the financial sector.

- Patience for Growth: Long-term focus enables the fund to withstand short-term fluctuations and capitalize on long-term trends.

- Strategic Planning: The fund can develop and execute long-term strategies to maximize returns and manage risks.

- Risk Management: By focusing on the long term, the fund can better manage risk and avoid knee-jerk reactions to short-term market movements.

- Consistent Returns: Long-term investments often lead to more stable and consistent returns over time.

Technological Integration

Investing in technology and innovation within the financial services sector ensures the fund stays ahead of industry trends and capitalizes on emerging opportunities. This proactive approach offers several key benefits:

- Competitive Edge: Embracing new technologies allows the fund to differentiate itself from competitors, attracting more investors and potentially increasing assets under management.

- Enhanced Efficiency: Adopting innovative technologies can streamline operations, reduce costs, and improve overall efficiency, leading to higher profitability.

- Improved Customer Experience: Investing in technology can enhance the customer experience by offering innovative financial products and services, leading to increased customer satisfaction and loyalty.

- Risk Management: Technology can help the fund better manage risks by providing real-time data and analytics, enabling more informed decision-making.

6. Forecasting Future Market Trends

Predicting future market trends is challenging but essential for investment success. Several methods and tools can help forecast market trends, including:

Technical analysis is a method used by traders and investors to analyze and forecast the future price movements of financial instruments, such as stocks, currencies, and commodities. It is based on the theory that historical price movements and trading volumes can provide insights into future price trends. Here’s how technical analysis works:

- Historical Price Charts: Technical analysts use price charts, such as line charts, bar charts, and candlestick charts, to visualize historical price movements over time. These charts display the open, high, low, and close prices for a given period, such as a day, week, or month.

- Key Concepts: Technical analysis relies on several key concepts, including support and resistance levels, trendlines, and chart patterns. Support levels are price levels where a security tends to stop falling and bounce back, while resistance levels are price levels where a security tends to stop rising and reverse direction. Trendlines are lines drawn on a chart to connect the highs or lows of an asset’s price movements, indicating the direction of the trend. Chart patterns, such as head and shoulders, triangles, and flags, are formations that can indicate potential future price movements.

- Indicators: Technical analysts use various technical indicators, such as moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence), to identify trends and momentum in price movements. These indicators are mathematical calculations based on historical price data and are used to generate buy or sell signals.

Fundamental Analysis

Evaluating economic indicators, industry trends, and financial statements to determine the intrinsic value of investments.

- Economic Indicators: Analysts evaluate economic indicators such as GDP growth, inflation rates, and unemployment levels to assess the overall health of the economy and its impact on investments.

- Industry Trends: Understanding trends within specific industries helps analysts identify growth opportunities and potential risks for investments.

- Financial Statements: Analyzing financial statements, including balance sheets, income statements, and cash flow statements, provides insights into a company’s financial health and performance.

- Intrinsic Value: By combining these analyses, analysts can determine the intrinsic value of investments, which is the true, underlying value of an asset based on its fundamentals.

Sentiment Analysis

Monitoring news, social media, and market sentiment to gauge investor emotions and predict market movements.

- News Monitoring: Keeping track of news articles, press releases, and financial reports to stay informed about events that may impact the market.

- Social Media Analysis: Monitoring social media platforms to gauge investor sentiment and identify trends that may affect market movements.

- Market Sentiment: Analyzing market sentiment through tools like sentiment analysis to understand investor emotions and predict potential market movements.

- Predictive Analytics: Using data analysis and machine learning techniques to predict future market trends based on current news, social media, and market sentiment.

7. How Investors Can Navigate Market Trends

Investors can take several steps to navigate market trends and optimize their investment in the Helios Financial Services Fund:

- Diversification: Spread investments across different financial sectors and geographies to reduce risk and enhance returns.

- Continuous Monitoring: Regularly review the fund’s performance and market trends to make informed investment decisions.

- Stay Informed: Keep abreast of economic indicators, industry trends, and market news to stay ahead of market movements.

- Consult with Financial Advisors: Seek advice from financial professionals to ensure your investment strategy aligns with your financial goals and risk tolerance.

Stay Informed

Regularly monitor financial news, economic indicators, and market trends to make informed investment decisions.

Diversify Investments

Diversifying investments across different asset classes and sectors can reduce risk and enhance returns.

Consult Financial Advisors

Seeking advice from financial advisors can provide valuable insights and help develop a personalized investment strategy.

Maintain a Long-term Perspective

Staying focused on long-term investment goals can help investors ride out short-term market volatility and achieve sustained growth.

8. FAQs about Market Trends and Helios Financial Services Fund

What are market trends?

Market trends refer to the general direction in which financial markets move over a period of time. They can be upward (bullish), downward (bearish), or neutral (sideways).

How do economic indicators affect market trends?

Economic indicators such as GDP growth, unemployment rates, and consumer spending influence market trends by affecting investor sentiment and financial performance.

How do interest rates impact the Helios Financial Services Fund?

Interest rates impact the profitability of financial institutions within the fund’s portfolio. Rising interest rates can increase borrowing costs but also improve margins for lenders.

How does technological advancement affect the Helios Financial Services Fund?

Technological advancements in financial services create new investment opportunities and challenges. The fund’s performance depends on its ability to invest in and adapt to these changes.

How can geopolitical events influence market trends?

Geopolitical events can create market volatility and uncertainty, impacting investor sentiment and financial markets. The fund must navigate these events to protect its investments.

Conclusion

Understanding and navigating market trends is crucial for the success of investment funds like the Helios Financial Services Fund. By staying informed, diversifying investments, and employing strategic approaches, both the fund managers and investors can optimize their performance and achieve their financial goals. The insights and strategies discussed in this blog provide a comprehensive guide for navigating the complex and dynamic world of financial markets.